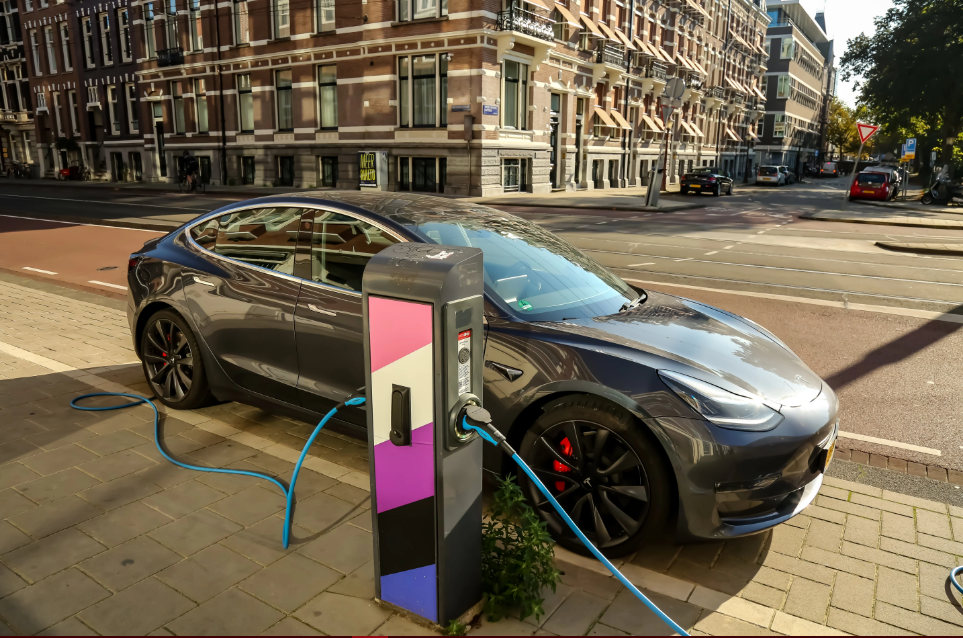

Why Are Electric Cars Expensive to Insure?

Electric cars have gained popularity in recent years due to their environmental benefits and potential cost savings in the long run. However, one aspect that often surprises potential electric car owners is the higher insurance costs associated with these vehicles. In this article, we will explore the reasons why electric cars are expensive to insure.

1: Cost of Repairs

One of the main factors contributing to the higher insurance costs for electric cars is the cost of repairs. Electric vehicles consist of advanced technologies and components that are often more expensive to repair or replace compared to traditional gasoline-powered cars. The specialized parts and technology used in electric cars can drive up repair costs, which insurance companies take into account when determining premiums.

2: Limited Availability of Repair Facilities

Another reason for the higher insurance costs is the limited availability of repair facilities for electric cars. Compared to traditional cars, there are fewer repair shops equipped to handle electric vehicle repairs. This scarcity of specialized repair facilities can result in longer repair times and higher costs, which insurance companies consider when calculating premiums.

3: Higher Replacement Costs

Electric cars tend to have higher replacement costs compared to their gasoline counterparts. The batteries used in electric vehicles are a significant component and can be quite expensive to replace. Insurance companies factor in these higher replacement costs when determining premiums, as the overall value of the vehicle plays a role in the insurance calculations.

4: Advanced Safety Features

Electric cars often come equipped with advanced safety features such as collision avoidance systems, autonomous driving capabilities, and advanced driver-assistance systems. While these safety features can potentially reduce the risk of accidents, they also increase the complexity of repairs and replacement costs. Insurance companies take into account the higher costs associated with repairing or replacing these advanced safety features, leading to higher insurance premiums.

5: Limited Data on Electric Cars

As electric cars are a relatively new addition to the automotive market, there is limited historical data available for insurance companies to assess the risks associated with these vehicles. This lack of data makes it challenging for insurers to accurately predict the likelihood of accidents, theft, or other potential risks, resulting in higher premiums to offset the uncertainty.

Make your Road Trips memorable with your own Premium Bike

6: Higher Vehicle Value

Electric cars, especially luxury models, tend to have a higher market value compared to traditional cars. The higher value of the vehicle itself contributes to higher insurance premiums. In the event of a total loss or theft, the insurance company would need to compensate the owner for the higher value of the electric car, leading to increased insurance costs.

Conclusion

While electric cars offer numerous benefits, such as environmental friendliness and potential cost savings in the long run, it is important to consider the higher insurance costs associated with these vehicles. Factors such as the cost of repairs, limited availability of repair facilities, higher replacement costs, advanced safety features, limited data, and higher vehicle value contribute to the increased insurance premiums for electric cars. As electric vehicles continue to evolve and gain popularity, it is expected that insurance costs will gradually adjust to reflect the changing landscape of the automotive industry.